MAKLUMAT AGENSI

Agensi kami menawarkan Pembaharuan Sijil Takaful kenderaan bermotor secara automatik yang membolehkan anda untuk melihat, menyimpan dan mencetak e-Nota Lindungan anda setelah transaksi selesai. Road Tax kereta pula dihantar ke tangan anda tanpa perlu beratur di JPJ atau pejabat pos, insyaAllah.

Nama Agen :

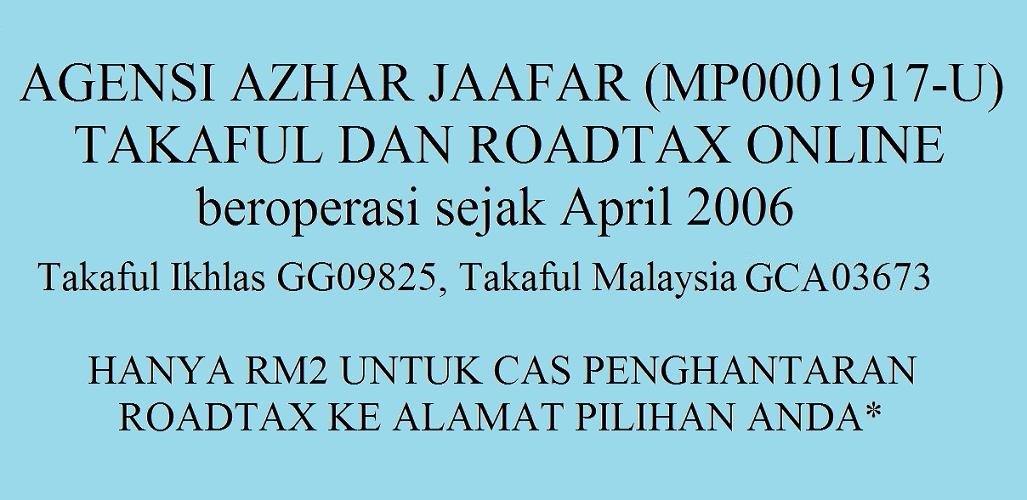

- AGENSI AZHAR JAAFAR (MP0001917-U)

- GG09825 (TAKAFUL IKHLAS BHD),

- GCA03673 (SYKT TAKAFUL MALAYSIA BHD)

Waktu Operasi : 9.00 pg - 1.00 tgh, 2 ptg - 4 ptg

(selain dari waktu ini, sila guna whatsApp atau email sahaja)

*Beroperasi sejak April 2006.

(selain dari waktu ini, sila guna whatsApp atau email sahaja)

*Beroperasi sejak April 2006.

|

| Takaful Ikhlas Award 2018/2019 |

***********************************************